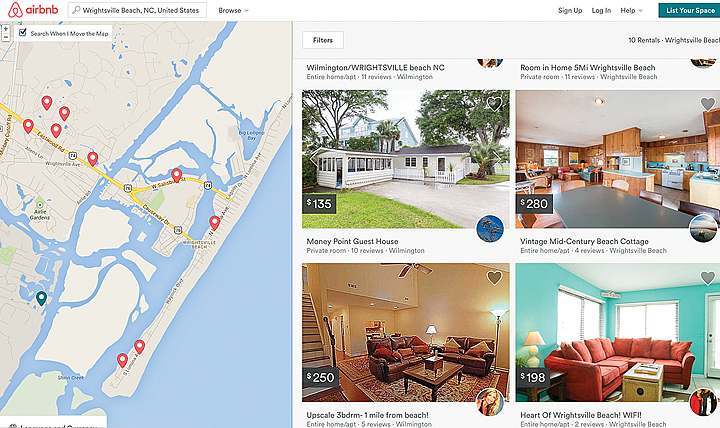

While tourism industry officials begin to recognize the niche filled by increasingly popular home sharing websites like Airbnb and Vacation Rentals by Owner (VRBO), questions about how to regulate the services remain unanswered.

Through the sites, homeowners advertise open rooms, even whole houses, as a way to bring in extra money. For guests, it is easy and fast to find a place to stay. The experience offers an opportunity for personal interaction. A host might prepare home-cooked meals for guests, share personal recommendations and insider information about local attractions, even accompany guests on outings.

Kim Hufham, Wilmington and Beaches Convention and Visitors Bureau president and CEO, said industry officials realize the sites are more than a passing trend.

“For the last couple of years, we’ve been monitoring it and we’ve heard now at a couple of the conventions we’ve been to recently that their inventory on the Airbnb total website is as large as the Sheridan properties. They’re there. It’s not just two or three properties per city,” Hufham said during an Aug. 28 phone interview.

With that realization, local authorities are looking for ways to ensure the New Hanover County’s 6 percent room occupancy tax is collected for the transactions. The tax, which pulled in more than $9 million from accommodations offered at hotels and motels, bed and breakfasts and vacation rentals during the 2013-14 fiscal year, funds promotion of the area as a tourism destination and renourishment projects at the county’s three beaches.

“What we’re hoping is that they put in some type of regulations for them, and with that, it would include that they charge and remit occupancy tax. … It needs to be an equitable situation, and that’s why it’s not fair when they don’t charge and remit the tax,” Hufham said.

Typically, no sales tax or room occupancy tax is collected through the sites. Airbnb, for example, holds hosts responsible for complying with local tax requirements, although recent agreements allow the site to collect hotel taxes in San Francisco and Oregon.

Hufham said she alerted the county tax office to the situation earlier in 2014. Roger Kelley, county tax administrator, said the sites are on his radar.

“We periodically check the various sites that are out there, and if we find someone, we send them a welcome-to-the-club letter and try to get them to pay up,” Kelley said during an Aug. 28 phone interview.

While Kelley is trying to keep an eye on the sites, he said limited resources prevent the office from tracking down hosts as diligently as he would like. He noted when tracking down listings, his staff discovered some of the homes advertised on the sites are listed by vacation rental companies.

email [email protected]